The day-to-day of a broker largely depends on the type and industry. They can buy and sell stocks, and have direct contact or communication with their respective clients. In the long run, they seek to enlarge their client base through a more creative means of advertising, or by conducting seminars to lure possible clients. They do this by keeping their clients informed of stock price fluctuations.

- While brokers typically work for broker-dealer firms, traders may work for either broker-dealers or investment banks.

- However, keep in mind that Wall Street traders are not the benchmark when it comes to trading success.

- If that’s the case, then the trader would trade based on what the firm wanted.

- That’s because it depends on you and your financial situation.

Dealers are regulated by the Securities and Exchange Commission (SEC). Dealers are important because they make markets in securities, underwrite securities, and provide investment services to investors. Conversely, retail traders access the market with their own money but tend not to do so for a living. This means that they’re more likely to operate on a part-time basis, while they may also open standard trading accounts or seek out lucrative forex bonus offers when getting started. Trading involves more frequent transactions, such as the buying and selling of stocks, commodities, currency pairs, or other instruments. The goal is to generate returns that outperform buy-and-hold investing.

Are you having trouble deciding between a career as a Wall Street trader or stockbroker? Both involve buying and selling securities, but the nature of each varies greatly. And these variations could make all the difference in determining which career will suit you best. «Broker» and «dealer» are U.S. regulatory terms and, as is often the case with legal terms, they are not very intuitive to many people. While the words are often seen together, they actually represent two different entities.

While there are pros and cons of partnering with a broker-dealer, the greater your grasp of the industry’s vocabulary, the better your starting point for understanding how the industry functions. In 2020, FINRA imposed fines of $57 million on brokerage firms. When you open an account with a broker-dealer, will be required to provide certain types of information. While dealers are in a separate registration category in the U.S., the term is used in Canada as the shortened version of “investment dealer»—the equivalent of a broker-dealer in the U.S.

However, brokers still play a vital role in providing liquidity and connecting traders to counterparties. In essence, while both brokers and traders play pivotal roles in the financial ecosystem, their functions, risk profiles, and rewards differ markedly. A broker is your go-to for seamless transactions and perhaps some investment advice, while a trader thrives on strategy, analysis, and market movements to generate profit. Dealers are people or firms who buy and sell securities for their own account, whether through a broker or otherwise.

However, stockbrokers and traders have strict requirements and regulations they must follow from the Financial Industry Regulatory Authority (FINRA) and the U.S. Any role that deals directly with securities or tradable assets typically involves oversight from both FINRA and the SEC. Traders who only buy and sell securities for their own portfolio may what is a book vs b book not need to adhere to these regulations, though. However, a trader can take on a number of different job titles. For example, a trader could be an investment banker working for a firm to raise money for other investing activities, like mergers and acquisitions. Or, a trader can work independently, trading securities for their personal portfolio.

Nowadays, a four-year college degree is a basic requirement—at least, if you want to work for a reputable financial institution or company. Most traders have degrees in math (especially accounting), finance, banking, economics or business. Not that liberal arts types can’t have successful careers as traders—any field that encourages research and analytic thinking develops useful skills. But make no mistake, number-crunching, finance, and business matters are a big part of the profession, so you need to be comfortable with them.

They need to manage their emotions and adhere to a well-defined trading plan to avoid impulsive and irrational decisions. Emotions such as fear and greed can significantly impact a trader’s performance and profitability. Therefore, traders must develop discipline and implement risk management strategies to mitigate the influence of emotions on their trading decisions. On the other hand, traders primarily work in finance, making securities sales and purchases for a financial institution. In this guide, we’ll go over what each job involves so you can determine which career is right for you. They deal with equities and bonds, as well as mutual funds, ETFs and other retail products as well as options for more sophisticated clients.

Also, beware of terminology nuances such as a dealing desk and non-dealing desk broker. The dealing desk broker or market maker literally makes the market by fixing its prices and making profits. This is thanks to a fixed margin between the selling and buying price, and becoming the opposite side of every deal, buyer or seller.

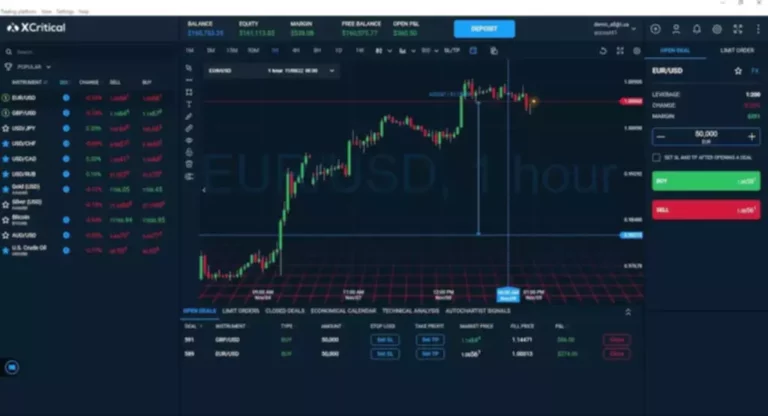

The main one is that the broker provides the trader with the platform to operate in the stock markets. Both investment bankers and traders work in stressful environments in which an enormous amount of capital is at risk and the overall firm counts on the fees to grow revenue. Although closely related and within the same financial services industry, each has a distinctive role and requires different skills and personality characteristics. Several of the advantages institutional traders once enjoyed over retail investors have dissipated. With the rise of the internet, more and more independent traders operate on their own accounts in the markets through online brokers.

They are responsible for obtaining and maintaining a roster of regular individual customers, also known as retail customers and/or institutional customers. Traders, on the other hand, tend to work for a large investment management firm, an exchange or a bank, and they buy and sell https://www.xcritical.in/ securities on behalf of the assets managed by that firm. Broker is an individual or firm which acts as an intermediary between a buyer and a seller, usually charging a commission for its services. A broker may also work as an agent on behalf of either party to a transaction.

Because Wall Street traders deal with sensitive financial matters like government securities, the bureau checks to see if you have a criminal past. That’s because if any information leaked, it can lead to damaging market speculation and economic espionage. To be a broker, you must get 72% or higher on the General Securities Representative Examination — more commonly referred to as the Series 7 exam.

Traders working in major investment banks may make more than those at smaller financial institutions. Similarly, those with many years of experience often make more and can charge more than those just starting their careers. Brokers act as a middleman between buyers and sellers, ensuring transactions run smoothly and everyone is fully informed. Yes, through direct stock purchase plans or electronic trading platforms, but brokers offer added convenience and expertise.