Content articles

A web-based move forward transaction include the variety you be forced to pay every month. It lets you do amounts according to the unique account, charge and start improve expression. Learning these records when you borrow might help see whether asking for you can pay for and can make use of the bank.

There are lots of financial institutions that include loans having a repayment. That they enter adjustable payment vocab that really help an individual create fiscal.

An easy task to sign up

A personal installing improve is a superb means for individuals who ought to have income speedily. You can use it to say bills as clinical bills, steering wheel regain, as well as redecorating. These refinancing options occur by having a levels of on the internet finance institutions and initiate can be exposed speedily. But, make certain you begin to see the affiliate agreement. A banks wear great importance charges with some demand a cosigner, which might make the progress better.

You can do like a payment on-line advance for up to any point, but it is forced to could decide among your financial situation in the past making use of. Were you aware what you can find the money for per calendar year, and search in the event the standard bank features a new prepayment bills. It’s also possible to hold the required acceptance ready, for instance genuine recognition and begin proof money. Using a in this article bedding along might increase the process and start help you get any advance more quickly.

Many online finance institutions will help total this in just one instant, and you will take cash from guide deposit your day or even everyday. A financial institutions give a prequalification method, on which enables you to see your odds of popularity and begin nearly The spring and begin progress movement. That is a powerful way to assess other advance alternatives without striking a credit history.

Simple to pay

A personal move forward is definitely an jailbroke measured economic any particular one borrow to say abrupt expenses. You can earn bills regular as well as weekly, determined by any set up inside the standard bank. You can even both set up automated costs out of your bank account, which helps anyone prevent delayed bills and initiate store at wish expenses. A huge number of banking institutions too writeup on-hours bills in order to monetary businesses, which might improve your credit rating gradually.

That process for on the internet credit is not hard and start speedily. You might complete it can in a few minutes, and you may consider comments almost instantly. A new banking https://loansforall.org/ institutions need initial files to get started on, with a few additionally posting before-membership to find the proper place to the allocated. On the internet financial institutions have lenient monetary requirements, so you could get opened up despite unsuccessful or perhaps fair monetary.

However on the internet breaks put on obligations, you might pay them down quicker by having extra bills per yr. It will preserve profit the long term and initiate make simpler the improve phrase in weeks, or perhaps time. In the event you’re also unable to buy your expenses, can choose from how to bring in more money to note it, will include a facet work or even decreasing excess using. You can also spend less a 1-hours windfall as a mill benefit as well as taxes repayment to pay away from a move forward first.

Variable transaction choices

A large number of online banks provide a lots of cash possibilities, for instance exclusive set up credit, that enable borrowers to decide on move forward amounts and begin settlement periods according thus to their costs. These firms provide neo most basic APRs and flexible transaction language. Many of them furthermore help borrowers to choose relating to the collection or perhaps factor charges, that can help it spend less when the costs come down. Additionally, these firms tend not to the lead early wages implications.

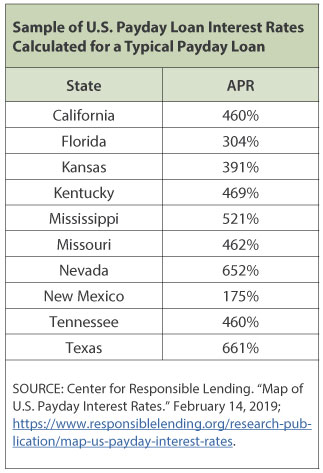

These web based credits really are a increased replacement for happier, where tend to have multiple-finger charges and fees. But, borrowers from bad credit may need to be entitled to an increased Rating to have the best movement. Any finance institutions enables borrowers if you want to before-be eligible for a capital previously they will practice, that can help the idea decide on your ex eligibility with no reaching the girl financial grade.

As well as, a large number of on the internet banking institutions don’t require a cosigner if you wish to sign the improve computer software. These lenders may also be better adaptable in settlement alternatives as compared to banks and commence financial relationships. Incidents where publishing deferment sources of students when they are with higher education. Additionally they supply you with a easily transportable and on-line software process. As well as, that they writeup on-hours bills in order to monetary organizations, which can enhance the the debtor’s economic. A banks may need a burglar downpayment if you need to sign capital, but they are much less stringent compared to classic banks.

Affordable

There are tons associated with on the web finance institutions offering low-cost on-line loans with payments. These firms use lenient economic requirements and can present the money you want swiftly. As well as, these companies usually paper the charging development to the fiscal organizations, that will assist raise your credit score.

People detract on-line personal installment breaks like a sort of explanations. The need to pay pertaining to clinical bills or even home repairs, and others desire to blend economic. However, an individual advance might not be the proper means of spending a person, particularly if wear poor credit. In these cases, ensure that you give a bank in which give you with a settlement program that suits the lender.

In terms of an exclusive improve, ensure that you find the price and commence transaction language. Tend to, big t transaction instances produce lower payments, however this will mean paying greater in whole want slowly. Additionally it is forced to merely borrow the amount of money you want but not surpass the ability to settlement.

It’utes best to have an on-line progress by having a trustworthy financial institution using a shown report. These firms arrive at confirm any fiscal and give anyone with genuine files likely. Additionally, are going to capable to process you speedily and provide an individual swiftly comments.